Bitcoin (BTC) Whales Accumulate as Market Faces Uncertainty

Bitcoin (BTC) has been trading below the $90,000 mark since March 7, struggling to regain upward momentum amid shifting market sentiment.

Meanwhile, technical indicators such as the Ichimoku Cloud and EMA lines suggest the trend remains bearish, though a potential reversal is not off the table.

Bitcoin Whales Just Hit Its Highest Level In More Than 3 Months

The number of Bitcoin whales—wallets holding at least 1,000 BTC—has been steadily increasing in recent weeks. On March 22, there were 1,980 such addresses, and that figure has since climbed to 1,991.

While a change of 11 might seem modest at first glance, it represents a meaningful uptick in large-scale accumulation, especially considering this is the highest number of BTC whales recorded in over three months.

Tracking Bitcoin whales is critical because these large holders often have the power to influence price movements due to the sheer size of their positions. An increase in whale addresses can signal rising confidence among institutional investors and high-net-worth individuals.

When more whales accumulate rather than distribute, it often suggests bullish sentiment and reduced selling pressure.

With the current whale count hitting a multi-month high, it could imply that significant players are positioning ahead of a potential upward move in Bitcoin’s price.

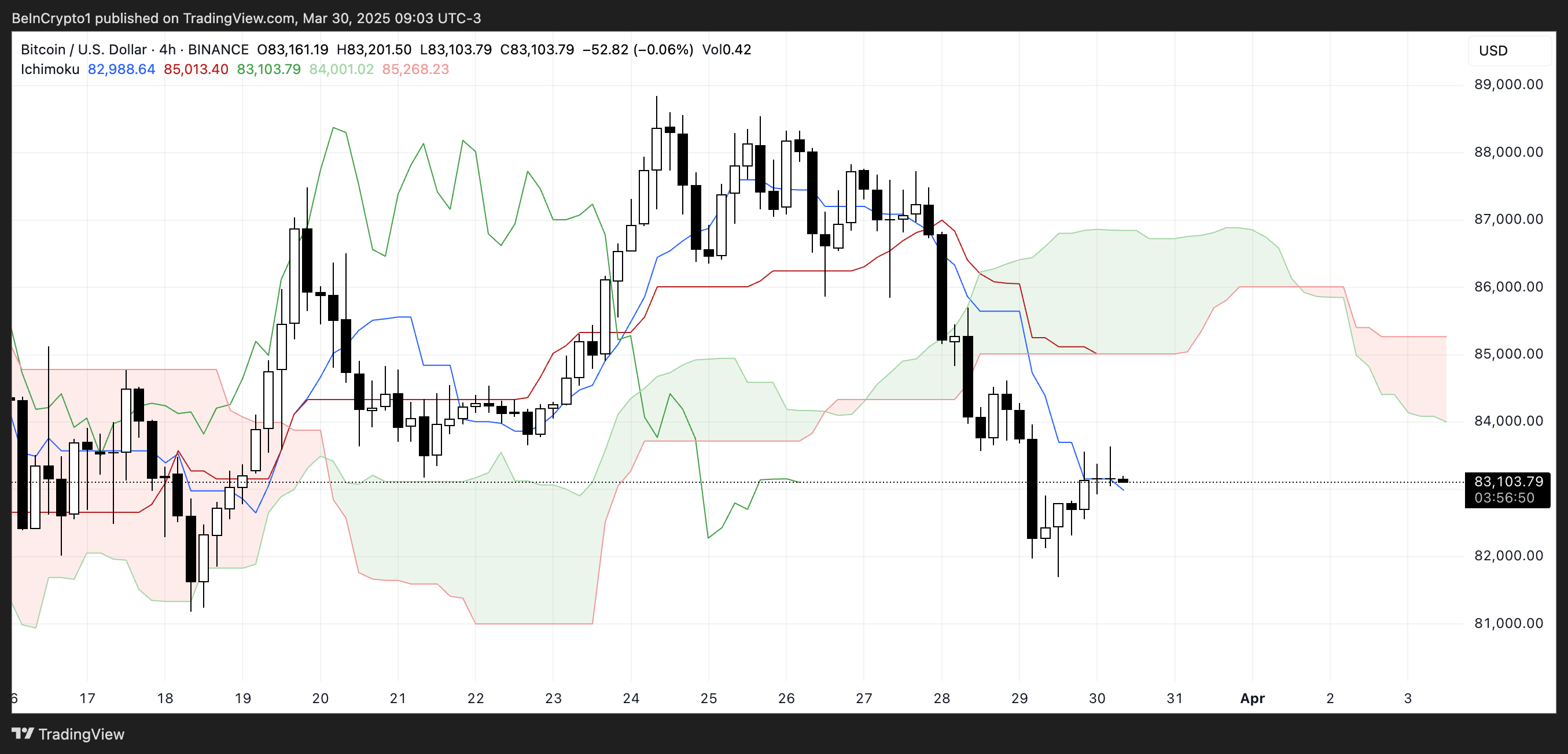

BTC Ichimoku Cloud Shows Challenges Ahead

The Ichimoku Cloud chart for Bitcoin shows the price consolidating just below the Kijun-sen (red line) after a strong downward move.

The Tenkan-sen (blue line) remains below the Kijun-sen, indicating short-term bearish momentum. Price action is attempting to stabilize but has yet to show a decisive shift in trend.

The Lagging Span (green line) trails below both the price and the cloud, reinforcing a bearish outlook from a historical perspective.

The Kumo (cloud) ahead is bearish, with the Senkou Span A (green cloud boundary) positioned below the Senkou Span B (red cloud boundary), and the cloud itself projecting downward.

This suggests resistance overhead and limited bullish momentum unless price manages to break through the cloud decisively.

The thin structure of the current cloud, however, hints at possible vulnerability—if buyers step in with strength, there could be a window for a reversal.

But for now, the overall setup favors caution, as the prevailing trend remains bearish according to Ichimoku principles.

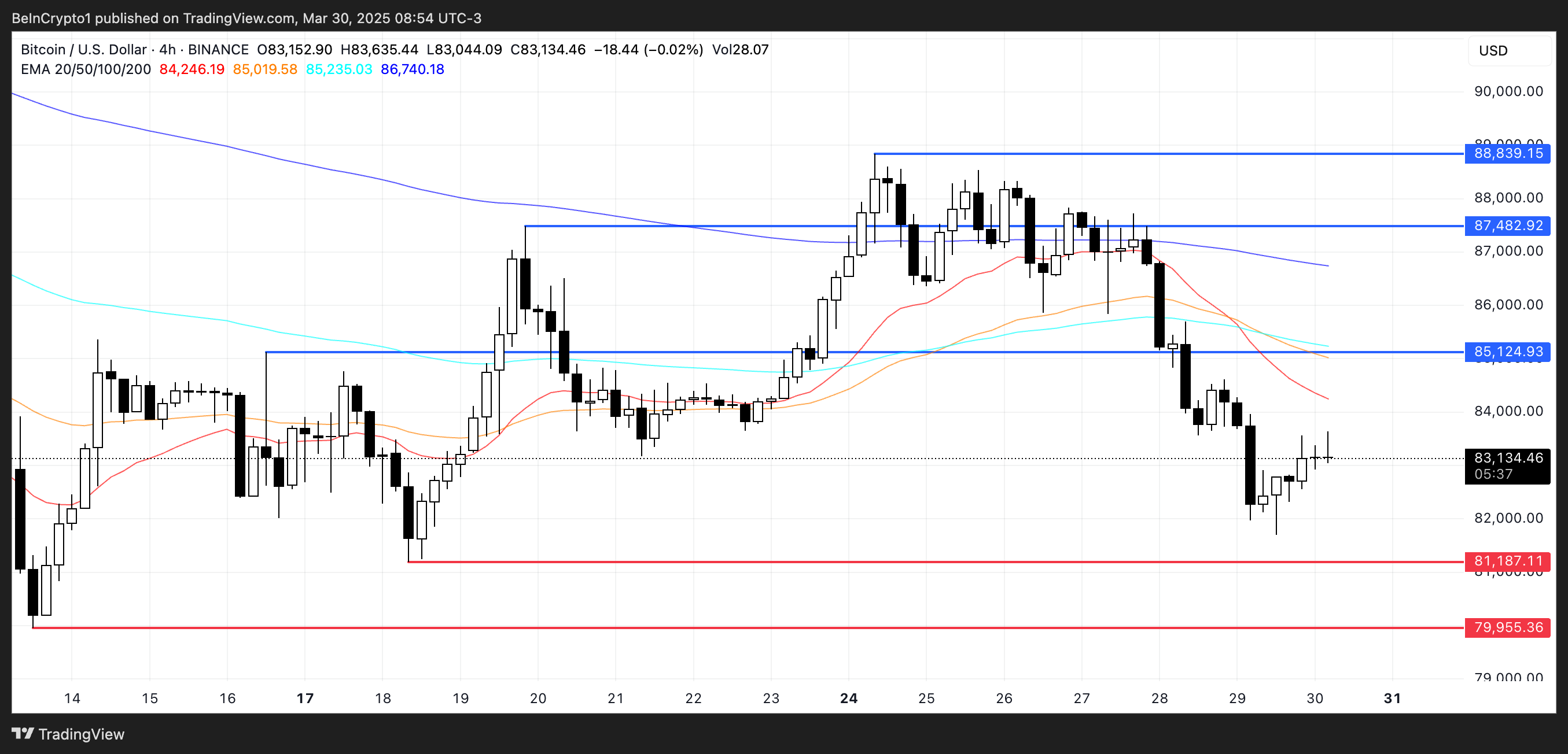

Can Bitcoin Rise To Test $88,000 Soon?

Bitcoin’s EMA lines continue to indicate a downtrend, with short-term moving averages positioned below the longer-term ones. This alignment suggests bearish momentum remains dominant for now.

However, if buyers can regain control and establish an uptrend, Bitcoin price may climb toward the next key resistance levels.

The first challenge would be the resistance near $85,124—if broken, this could open the path to $87,482 and potentially $88,839, assuming bullish momentum strengthens and sustains.

On the flip side, failure to build upward momentum would reinforce the current bearish structure.

In that case, Bitcoin could revisit the support level around $81,187.

A breakdown below this point would further validate the downtrend, potentially dragging the price down to $79,955.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.