Robinhood debuts presidential election betting, stock climbs 4%

Key Takeaways

Robinhood’s stock increased by 4% following the announcement of its election trading feature.

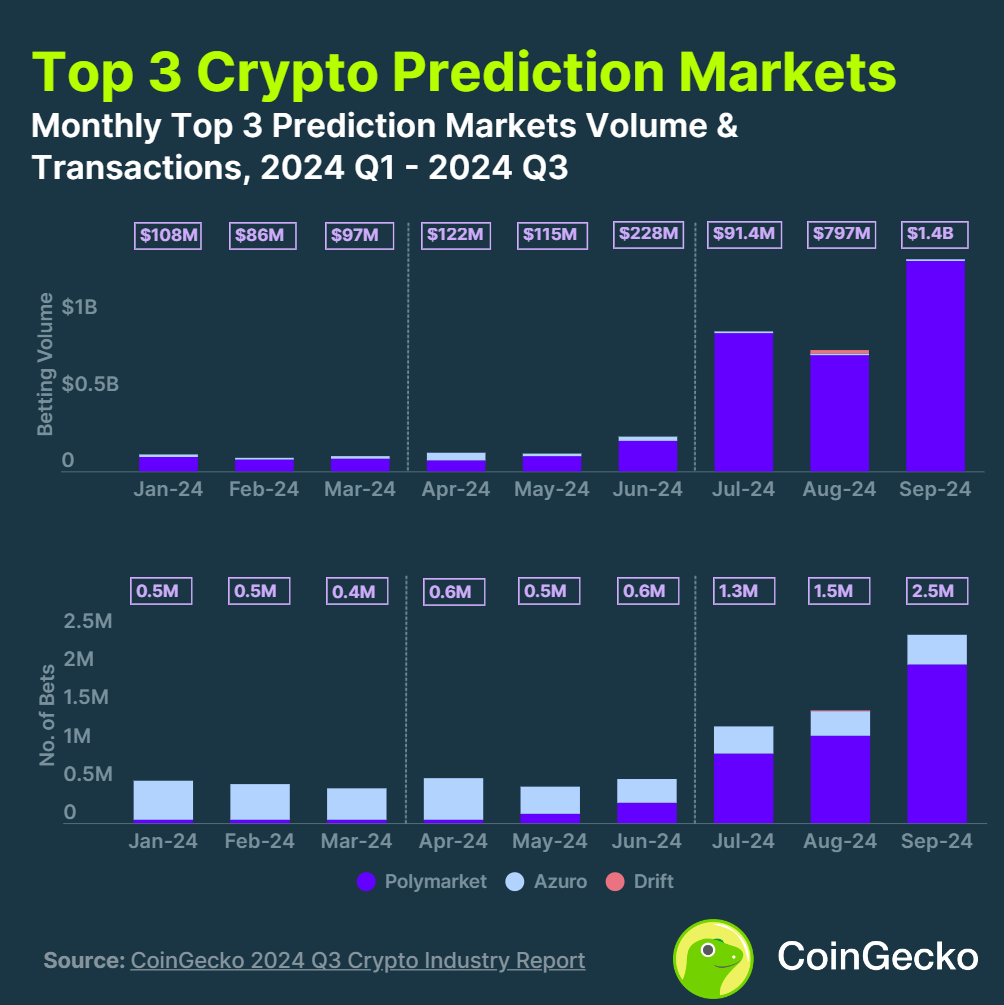

The political prediction market’s volume surged 565% in Q3.

Share this article

Robinhood Markets (HOOD) saw its stock price increase by almost 4% to $28 after the US market opened on Monday, according to Yahoo Finance data. The rise followed the company’s announcement of its new political prediction market, which allows trading on the outcome of the upcoming US presidential election.

The launch comes just eight days before the election, enabling users to trade contracts for candidates Kamala Harris and Donald Trump through its Robinhood Derivatives unit in partnership with Interactive Brokers’ ForecastEx.

Initially available to a select group of customers, applicants must meet specific criteria, including US citizenship, to participate. The new offering follows Robinhood’s recent expansion into 24/5 trading and upcoming futures trading as part of its commitment to providing real-time market access.

Prediction markets saw a dramatic increase in the third quarter of this year, with around 565% rise in betting volume, totaling $3.1 billion, according to a recent report from CoinGecko. The surge was mainly driven by the highly anticipated US presidential election, particularly the impact on crypto regulations following the key event.

Polymarket, a leading decentralized platform, dominated with over 99% market share, with $1.7 billion wagered on the “US Presidential Election Winner,” representing about 46% of its annual volume.

As of October 27, Polymarket’s total value locked stood at $302 million, up almost 140% over the last month, according to data from DefiLlama.

Apart from Robinhood, Wintermute is another entity that aims to capitalize on the growing interest in prediction markets. Wintermute said last month it planned to launch a new prediction market called “OutcomeMarket,” which also focuses on the upcoming US presidential election.

As noted, OutcomeMarket will be a multi-chain platform that allows users to trade contracts based on the election outcomes for candidates Donald Trump and Kamala Harris. The platform is expected to introduce two tokens, TRUMP and HARRIS, which can be traded on dApps as well as centralized exchanges.

Share this article